Nearly five years since the global pandemic began, much of life has gotten back to normal. Unemployment rates are low, employer surveys indicate an easier time attracting and retaining talent, and business continues to pick up. The U.S. Treasury reports that more than 70 percent of small businesses expect revenue growth over the next 12 months and a surge in entrepreneurship, as more Americans start businesses of their own.

While business is looking up, which is good news for both employers and the workforce, it might come as a surprise to learn that many employees are experiencing a financial crisis.

Under financial pressure

A recent report from Bank of America finds that employee financial stress is at an all-time high, with 64% of those surveyed saying they are struggling to manage short-term expenses as well as meet long-term financial goals. Among the study’s key findings:

- As much as one-third of employees have saved less than $5,000 for retirement.

- 30% women

- 23% men

- Younger workers are burdened with student loan debt.

- 25% Gen Z and Millennials have student loans

- 13% of Gen X have student loans

- Older generations are at risk of not having enough money to retire.

- Gen X: Only 2 in 10 on track

- Boomers: Only 3 in 10 on track

- Lower income groups struggle to make ends meet, covering unmet needs, unexpected expenses or job loss with credit cards.

- 67% have less than a month’s expenses saved for an emergency

How did we get here?

While the economy has been stabilizing and heavy inflation slowing in 2024, wages have remained flat, and in some cases fallen, while the cost of living has surpassed wage increases for the past three years. As a result, employees say they are struggling to afford basic living expenses.

How did we get here?

Employees say they are struggling to afford basic living expenses.

Forbes reports that employees’ chief financial stressors are rising housing costs (55%), increasing prices for everyday essentials (41%), salaries not keeping pace with inflation (34%) and the inability to save for the future (33%). On top of this, a tightening labor market means employees have fewer opportunities to change companies for better paying positions.

Zoom in

Experts say that companies are correcting course in a post-pandemic world. In 2020, employers increased wages to help fill open positions. That trend peaked in 2022, when wage growth hit 9.8% year-over-year, and employers were pressed to fill open positions brought on by the Great Resignation, when an unprecedented number of employees quit their jobs in search of better compensation and more personally fulfilling work. Oversupply in the market has led to mass layoffs, fewer job postings and a precipitous drop in wage growth to just 3.6% in 2024.

Anxiety’s impact on your workforce

The longer employees fall behind on bills, rack up credit card debt and live paycheck-to-paycheck, the bigger the impact on their health and wellbeing, which inevitably impacts mood and performance at work.

A 2024 workforce survey by Betterment found that one in five workers say they experience financial stress on a daily basis. Even more, 62% say their anxiety is moderate to significant, which is impacting their job.

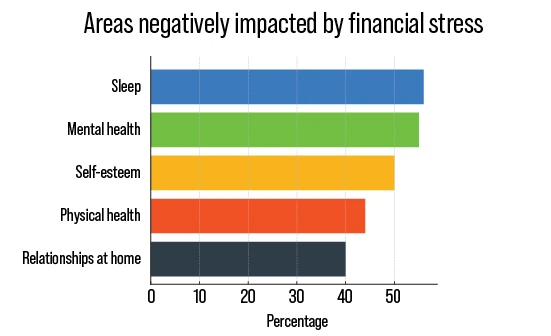

Financial stress goes beyond managing the bank account, taking a toll on employee health and wellbeing. A survey by PwC found that financial stress and money worries negatively impacted employees across several areas, including:

- Sleep (56%)

- Mental health (55%)

- Self-esteem (50%)

- Physical health (44%)

- Relationships at home (40%)

Moreover, employees report that financial stress is a distraction at work that impacts their performance. The report finds that these distractions impact productivity as workers spend time dealing with personal finances. Financially stressed employees are also less engaged, less energized, have lower morale and are twice as likely to be looking for a new job.

How employers can help

Most employers offer financial benefits such as health savings accounts (HSAs) and retirement savings programs such as 401(k) plans. But there are many other areas of life that these perks don’t account for, whether that’s buying a house, paying off student loans or planning a vacation.

Additional financial benefits to consider:

Financial coaching and tools:

Financial health programs can help employees better understand how to manage their money and see how their daily decisions about spending impact their lives. Financial education comes in many shapes and sizes, including: AI learning management systems, live certified financial coaches, digital tools such as calculators, budget planners and apps, online resource libraries and workshops.

Emergency savings:

In a 2024 survey of employers, the Employee Benefit Research Institute found that many employers want to help workers improve their financial health. One way to do that is through an employer-sponsored emergency savings account, which deducts a portion of an employee’s paycheck to use for unexpected expenses. As many as 7 in 10 employers said they plan to offer an emergency savings account within the next couple of years.

Salary advances:

HR Dive notes that employees who are in financial crisis need access to immediate resources to keep them from falling victim to high-interest payday loans, overdraft fees and other predatory practices. Smaller salary advances, paid back over time, can help employees get through a rough patch.

Commuter benefits:

Analysts found that metro Atlanta residents spend an average of 22% of their incomes on commuting costs — or more than $10K annually. Commuter programs, such as carpools, vanpools and telework, help employees with accessible and reliable transportation options that also saves a significant portion of their paycheck instead of allocating dollars toward gas, car maintenance and parking fees. Employers may also offer discounted transit passes or help employees purchase them with pre-tax dollars.

Employers are in a unique position to support employee financial wellness — and doing so can boost workforce and business goals. Learn more about how your teams’ financial health can make your company stronger and yield measurable ROI in 3 Ways Financial Wellness Benefits Employers.

Bank of America research found that 8 in 10 employers say financial wellness tools have a positive impact on retention and even help attract higher quality talent — yet only 28% of employers have them.

The Takeaway

Financial wellness benefits won’t solve employees’ financial hardships overnight, but they’re a great first step. Financial health offerings create a culture of caring, making employees feel seen, heard and valued, which boosts trust, loyalty, productivity and your company’s reputation.

Georgia Commute Options — a program made possible by the Atlanta Regional Commission and the Georgia Department of Transportation — can help you find the right blend of employee commute strategies that suit your business. Contact us today to schedule a free, no-obligation consultation.